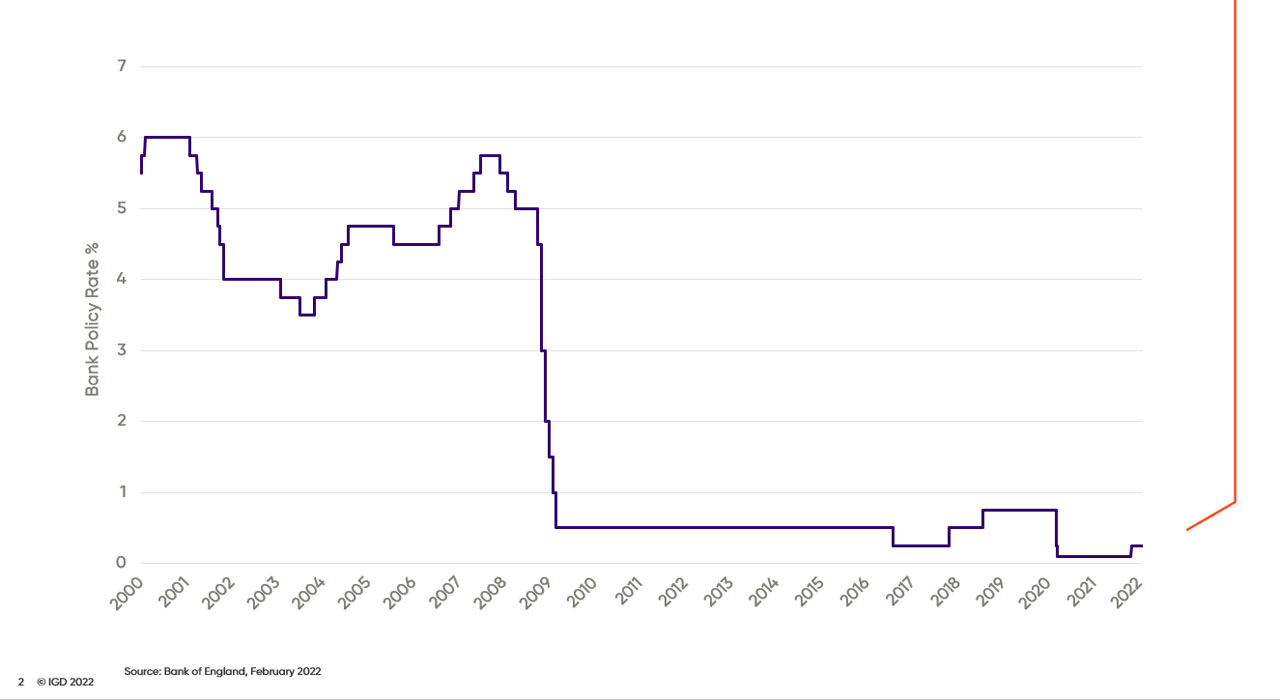

Bank of England base rate

The Base Rate is the interest rate set by the Bank of England and is also known as the official Bank Rate. Just a week before that it was cut to 025.

Bank Of England Makes Biggest Rate Rise Since 1995 Fox Business

The bank rate was cut in March this year to 01.

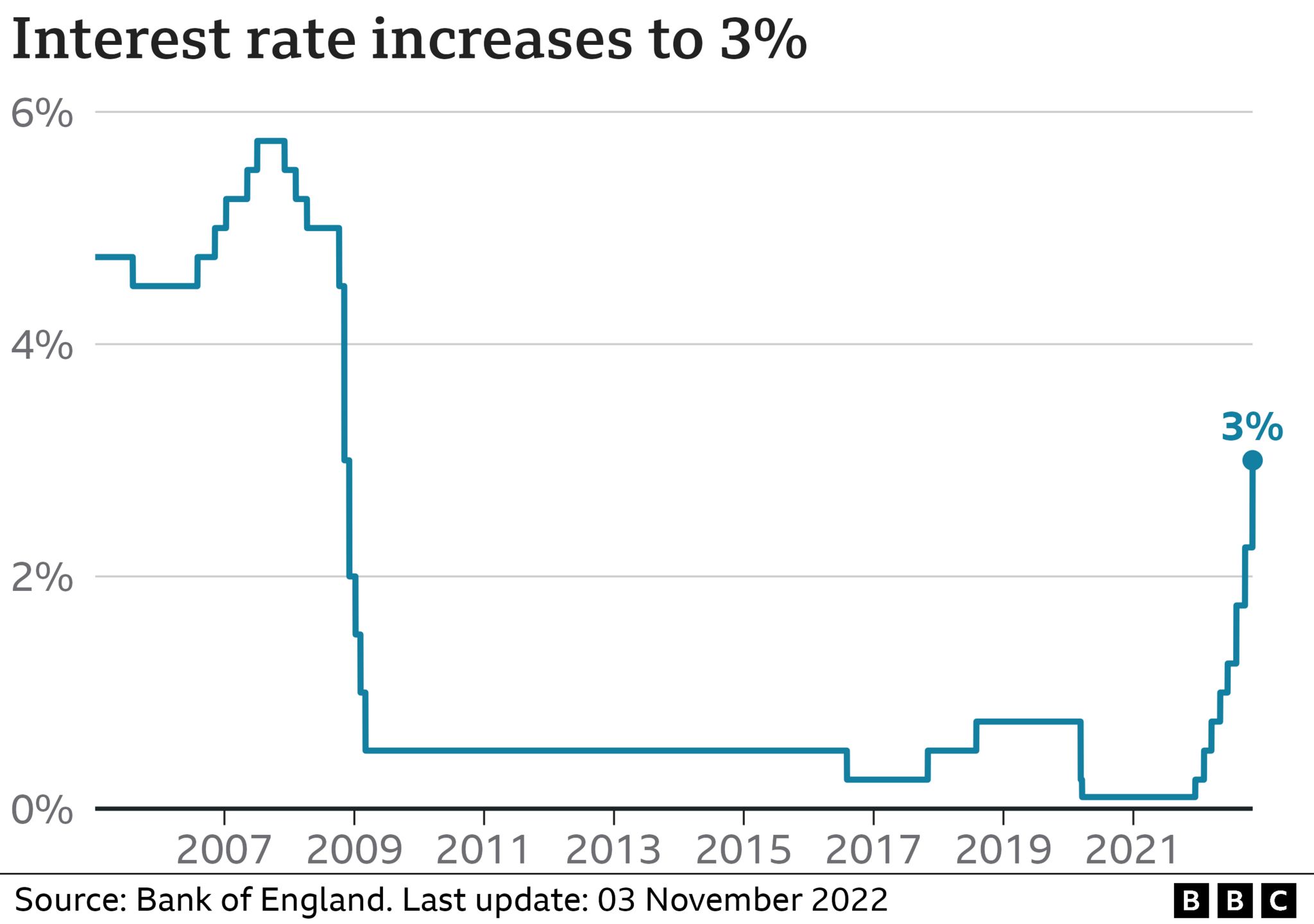

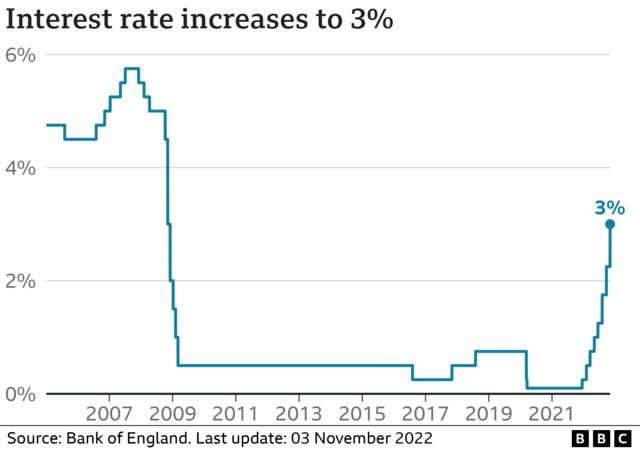

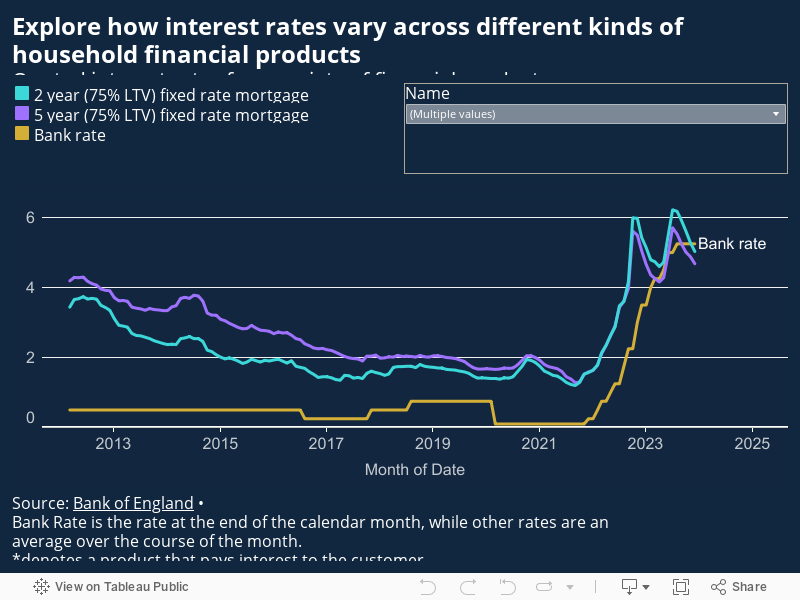

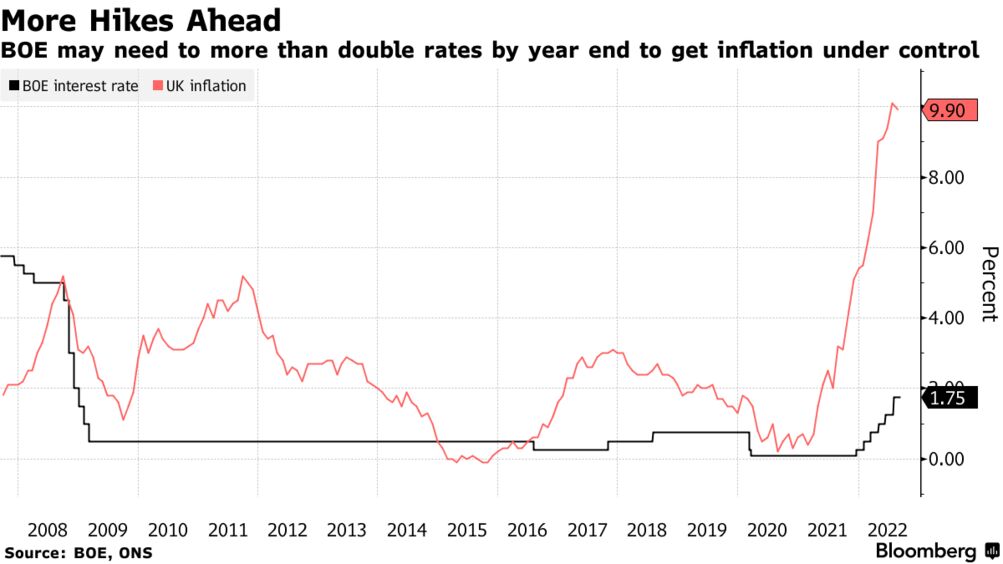

. The base rate dropped to an all time low of 01 following the outbreak of the coronavirus pandemic in March 2020. Fears that the Banks base rate would jump by more than one percentage point above its current level of 225 have calmed. The global financial crisis causes the UK interest rate to drop to a low.

The base rate was increased from 175 to 225 on 22 September 2022. The key difference between bank rate and base rate is that the bank rate is the rate at which the central bank in the country lends money to commercial banks while base rate is. The BoE took the bank rate down to an all-time low of 01 in March 2020.

47 rows The Bank of England base rate is the UKs most influential interest rate and its official. The Bank of England said rates are unlikely to rise above 5. LONDON The Bank of England voted to raise its base rate to 225 from 175 on Thursday lower than the 075 percentage point increase that had been expected by many.

Thu 20 Oct 2022 1027 EDT Last modified on Thu 20. The Bank of England announced its seventh interest rate hike in less than a year on Thursday despite forecasting a recession as it battles the highest level of inflation of any. Bank of England says UK in recession as it.

The Bank of England base rate is currently. 3 despite a plummet in sterling but will make big moves in November. Before the recent cuts it sat at.

Our mission is to deliver monetary and financial stability for the people of the United Kingdom. The current Bank of England base rate is 225. The Bank of England base rate is currently 225.

1 day agoThe Bank of England raised interest rates by three quarters of a percentage point on Thursday the biggest hike in 33 years as it tries to contain soaring inflation even as the UK. Now a period of high inflation is causing the BoE to accelerate its schedule of rate rises. The Bank of England BoE is the UKs central bank.

The Bank of Englands base interest rate is currently 225. Continue reading to find out more about how this could affect you. The Bank of England wont raise interest rates before its next scheduled policy announcement on Nov.

It was cut twice in March 2020 to ease the economic pressure caused by the coronavirus pandemic from 075. The base rate is effectively increased over the next few years to combat high inflation. The base rate was previously reduced to 01 on.

Market Expectations For Bank Of England Rate Rise Shift To Early 2022 Financial Times

Bank Of England Preview Edging Towards A 2022 Rate Hike Article Ing Think

What Are Interest Rates Bank Of England

Bank Of England Weighs Biggest Interest Rate Rise In 33 Years Bloomberg

Bank Of England Raises Uk Interest Rates And Warns Of 10 Inflation

Bank Of England Raises Interest Rates To 2 25 Youtube

Boe Official Bank Rate British Central Bank S Current And Historic Interest Rates

Bank Of England Increases Interest Rates Amid Inflation Concerns

Bank Of England Interest Rates Rise 0 5 To 2 25 Messenger Newspapers

Bank Of England Makes Biggest Interest Rate Hike In 30 Years Fox Business

Bank Of England Predicted To Raise Rates For Second Time In Quick Succession Financial Times

How The Bank Of England Set Interest Rates Economics Help

Bank Of England Interest Rate Hike Is Biggest In Three Decades But Dovish Commentary Hits The Pound Marketwatch

Q A Kpmg Assesses Tp Implications Of Boe Interest Rate Rise International Tax Review